Statistical & Financial Consulting by Stanford PhD

Home Page

EUROPEAN OPTION

= \max\{S - K, 0\}) (call option)

(call option)

= \max\{K - S, 0\}) (put option)

(put option)

Over the last 40 years, substantial body of methods has been developed to price options, with the Black-Scholes formula, volatility interpolation schemes and stochastic volatility models being the centerpiece. At this point the field is well-researched but there are still some interesting questions remaining. For example, much profit depends on how we choose daytime conventions. Which time length do we assign to week-ends and holidays relative to regular business days? Sometimes big developments may happen over the week-end, with elections being a notable example. In other cases the week-end brings little news but still serves as an opportunity for the market to start the next week from the "blank sheet". In other cases there are no changes at all.

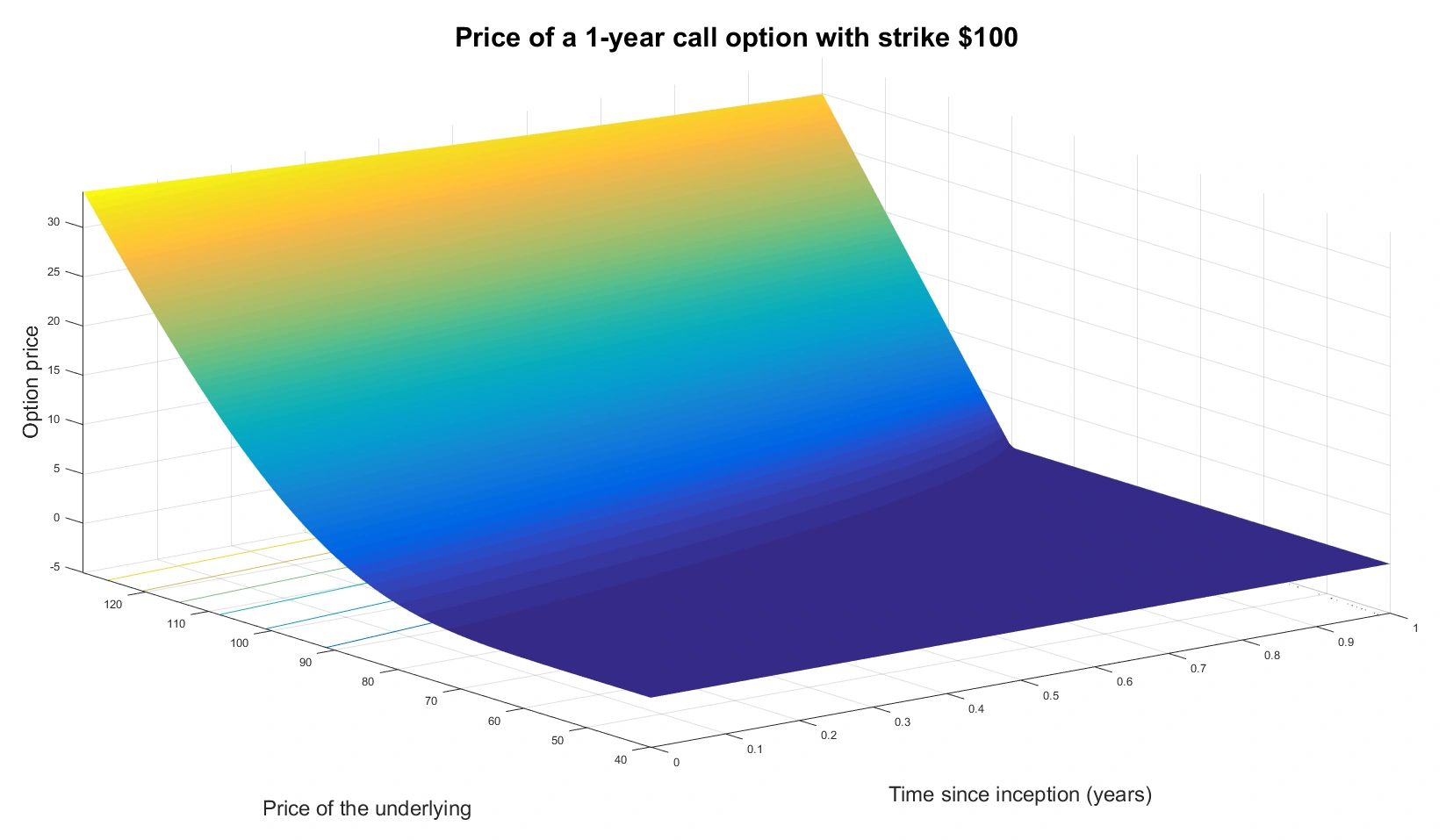

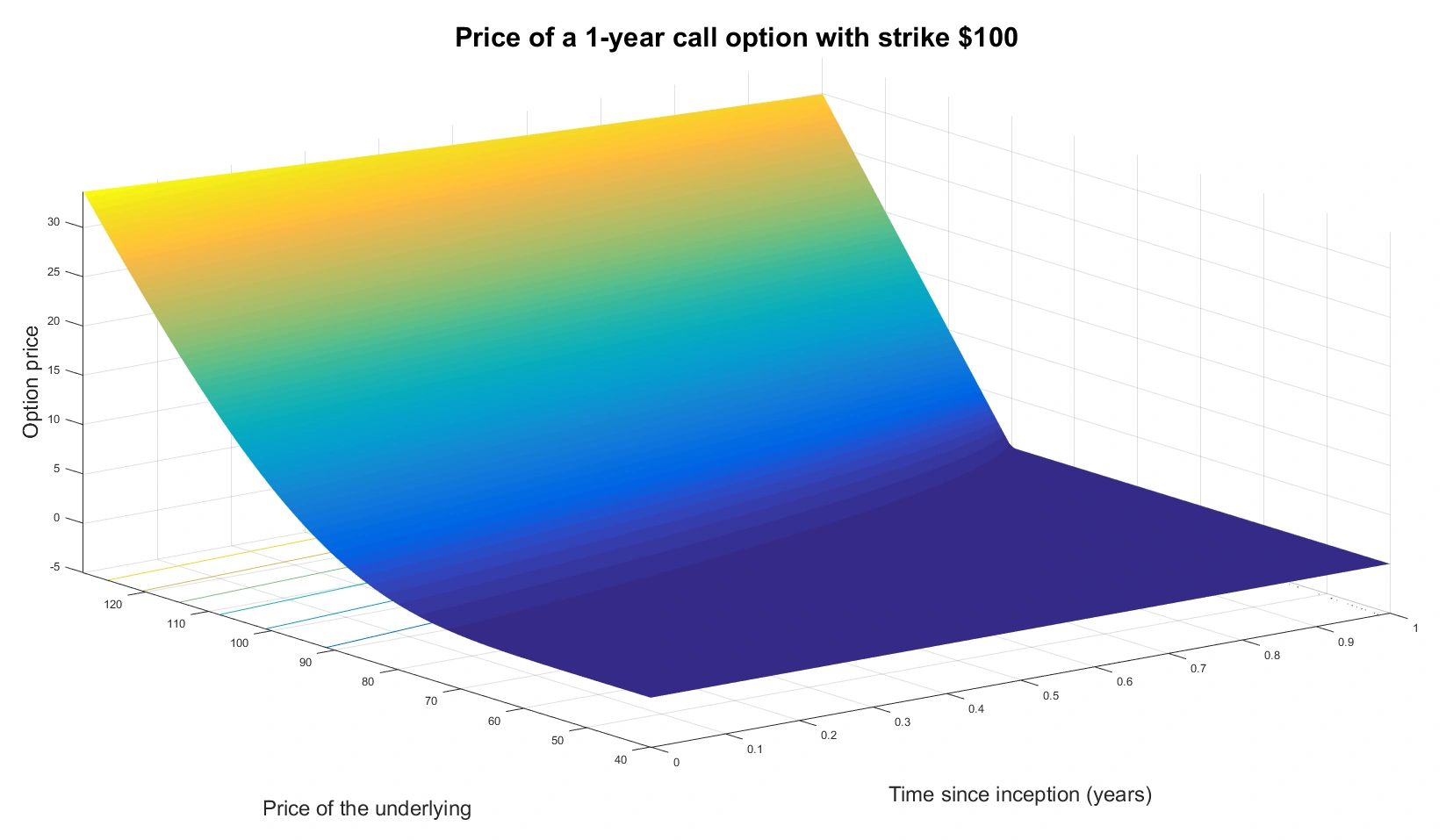

The price of a typical call option is illustrated in the graph below.

EUROPEAN OPTION REFERENCES

Hull, J. (2011). Options, Futures, and Other Derivatives (8th ed). Pearson / Prentice Hall.

Duffie, D. (2001). Dynamic Asset Pricing Theory (3rd ed). Princeton University Press.

Bjork, T. (2009). Arbitrage Theory in Continuous Time (3rd ed). Oxford University Press.

Lipton, A. (2001). Mathematical Methods for Foreign Exchange: A Financial Engineer's Approach. World Scientific.

Taleb, N. (1997). Dynamic Hedging: Managing Vanilla and Exotic Options. Wiley Finance, New York.

Passarelli, D. (2008). Trading Option Greeks: How Time, Volatility, and Other Pricing Factors Drive Profit. Bloomberg Press, New York.

EUROPEAN OPTION RESOURCES

BACK TO THE FINANCIAL TOPICS DIRECTORY

IMPORTANT LINKS ON THIS SITE

European Option is a contract that can be exercised on the expiration date only. A call option gives the holder the right to buy the underlying asset at a certain prespecified price, called strike. A put option give the holder the right to sell the underlying asset at the strike. If

is the strike and

is the underlying price at expiration, then the terminal payoffs can be written as

Over the last 40 years, substantial body of methods has been developed to price options, with the Black-Scholes formula, volatility interpolation schemes and stochastic volatility models being the centerpiece. At this point the field is well-researched but there are still some interesting questions remaining. For example, much profit depends on how we choose daytime conventions. Which time length do we assign to week-ends and holidays relative to regular business days? Sometimes big developments may happen over the week-end, with elections being a notable example. In other cases the week-end brings little news but still serves as an opportunity for the market to start the next week from the "blank sheet". In other cases there are no changes at all.

The price of a typical call option is illustrated in the graph below.

EUROPEAN OPTION REFERENCES

Hull, J. (2011). Options, Futures, and Other Derivatives (8th ed). Pearson / Prentice Hall.

Duffie, D. (2001). Dynamic Asset Pricing Theory (3rd ed). Princeton University Press.

Bjork, T. (2009). Arbitrage Theory in Continuous Time (3rd ed). Oxford University Press.

Lipton, A. (2001). Mathematical Methods for Foreign Exchange: A Financial Engineer's Approach. World Scientific.

Taleb, N. (1997). Dynamic Hedging: Managing Vanilla and Exotic Options. Wiley Finance, New York.

Passarelli, D. (2008). Trading Option Greeks: How Time, Volatility, and Other Pricing Factors Drive Profit. Bloomberg Press, New York.

EUROPEAN OPTION RESOURCES

BACK TO THE FINANCIAL TOPICS DIRECTORY

IMPORTANT LINKS ON THIS SITE

- Detailed description of the services offered in the areas of statistical consulting and financial consulting: home page, types of service, experience, case studies, payment options and finance tutoring

- Directory of statistical analyses